InIndia, a commodity based economy wh ere two-third of the one billion population depends on agricultural commodities, surprisingly has an under developed commodity market. Unlike the physical market, futures markets trades in commodity are largely used as risk management (hedging) mechanism on either physical commodity itself or open positions in commodity stock.

For instance, a jeweler can hedge his inventory against perceived short-term downturn in gold prices by going short in the future markets.

The article aims at know how of the commodities market and how the commodities traded on the exchange. The idea is to understand the importance of commodity derivatives and learn about the market from Indian point of view. In fact it was one of the most vibrant markets till early 70s. Its development and growth was shunted due to numerous restrictions earlier. Now, with most of these restrictions being removed, there is tremendous potential for growth of this market in the country.

Definitions of Commodity market .

Commodity markets are markets where raw or primary products are exchanged. These raw commodities are traded on regulated commodities exchanges, in which they are bought and sold in standardized contracts.

Commodities trading.

Spot trading.

Spot trading is any transaction where delivery either takes place immediately, or with a minimum lag between the trade and delivery due to technical constraints. Spot trading normally involves visual inspection of the commodity or a sample of the commodity, and is carried out in markets such as wholesale markets . Commodity markets, on the other hand, require the existence of agreed standards so that trades can be made without visual inspection.Forward contracts.

A forward contract is an agreement between two parties to exchange at some fixed future date a given quantity of a commodity for a price defined today. The fixed price today is known as the forward price.Futures contracts.

A futures contract has the same general features as a forward contract but is transacted through a futures exchange.Commodity and futures contracts are based on what’s termed forward contracts. Early on these forward contracts — agreements to buy now, pay and deliver later — were used as a way of getting products from producer to the consumer. These typically were only for food and agricultural products. Forward contracts have evolved and have been standardized into what we know today as futures contracts. Although more complex today, early forward contracts for example, were used for rice in seventeenth century Japan. Modern forward, or futures agreements, began in Chicago in the 1840s, with the appearance of the railroads. Chicago, being centrally located, emerged as the hub between Midwestern farmers and producers and the east coast consumer population centers.

In essence, a futures contract is a standardized forward contract in which the buyer and the seller accept the terms in regards to product, grade, quantity and location and are only free to negotiate the price.

Hedging.

Hedging, a common (and sometimes mandatory practice of farming cooperatives, insures against a poor harvest by purchasing future contracts in the same commodity. If the cooperative has significantly less of its product to sell due to weather or insects, it makes up for that loss with a profit on the markets, since the overall supply of the crop is short everywhere that suffered the same conditions.Whole developing nation may be especially vulnerable, and even their currency tends to be tied to the price of those particular commodity items until it manages to be a fully developing nation .For example, one could see the nominally fiat money of Cuba as being tied to sugar prices since a lack of hard currency paying for sugar means less foreign goods per peso in Cuba itself. In effect, Cuba needs a hedge against a drop in sugar prices, if it wishes to maintain a stable quality of life for its citizens.

Delivery and condition guarantees.

In addition, delivery day, method of settlement and delivery point must all be specified. Typically, trading must end two (or more) business days prior to the delivery day, so that the routing of the shipment can be finalized via ship or rail, and payment can be settled when the contract arrives at any delivery point.Standardization.

U.S. soybean futures, for example, are of standard grade if they are "GMO or a mixture of GMO and Non-GMO No. 2 yellow soybeans of Indiana, Ohio and Michigan origin produced in the U.S.A. (Non-screened, stored in silo)," and of deliverable grade if they are "GMO or a mixture of GMO and Non-GMO No. 2 yellow soybeans of Iowa, Illinois and Wisconsin origin produced in the U.S.A. (Non-screened, stored in silo)." Note the distinction between states, and the need to clearly mention their status as GMO (genetically modified organism) which makes them unacceptable to most organic food buyers.Similar specifications apply for cotton, orange juice, cocoa, sugar, wheat, corn, barley,pork bellies, milk, feedstuffs, fruits, vegetables, other grains, other beans, hay, other livestock, meats, poultry, eggs, or any other commodity which is so traded.

Regulation of commodity markets.

Cotton, kilowatt-hours of electricity, board feet of wood, long distance minutes, royalty payments due on artists' works, and other products and services have been traded on markets of varying scale, with varying degrees of success.Generally, commodities' spot and forward prices are solely dependent on the financial return of the instrument, and do not factor into the price any societal costs, e.g. smog, pollution, water contamination, etc. Nonetheless, new markets and instruments have been created in order to address the external costs of using these commodities such as man-made global warming, deforestation, and general pollution. For instance, many utilities now trade regularly on the emissions markets, buying and selling renewable emissions credits and emissions allowances in order to offset the output of their generation facilities. While many have criticized this as a band-aid solution, others point out that the utility industry is the first to publicly address it's external costs. Many industries, including the tech industry and auto industry, have done nothing of the sort.

In the United States, the principal regulator of commodity and futures markets is the commodity future trading but it is the national futures association that enforces rules and regulations put forth by the CFTC.

Oil.

Building on the infrastructure and credit and settlement networks established for food and precious metal, many such markets have proliferated drastically in the late 20th century. Oil was the first form of energy so widely traded, and the fluctuations in the oil markets are of particular political interest.Some commodity market speculation is directly related to the stability of certain states, e.g. during the Persian gulf war, speculation on the survival of the regime of saddam hussain in Iraq Similar political stability concerns have from time to time driven the price of oil.

The oil market is an exception. Most markets are not so tied to the politics of volatile regions - even natural gas tends to be more stable, as it is not traded across oceans by tanker as extensively.

Commodity markets and protectionism.

Developing countries (democratic or not) have been moved to harden their currencies, accept IMF rules, join the WTO, and submit to a broad regime of reforms that amount to a hedge against being isolated. China's entry into the WTO signalled the end of truly isolated nations entirely managing their own currency and affairs. The need for stable currency and predictable clearing and rules-based handling of trade disputes, has led to a global trade hegemony - many nations hedging on a global scale against each other's anticipated protectionism were they to fail to join the WTOThere are signs, however, that this regime is far from perfect. U.S. trade sanctions against Canadian softwood lumber (within NAFTA) and foreign steel (except for NAFTA partners Canada and Mexico) in 2002 signalled a shift in policy towards a tougher regime perhaps more driven by political concerns - jobs, industrial policy, even sustainable forestry and logging practices.

Largest commodities exchanges.

CME Group | USA | |

Tokyo commodity exchange | Japan | - |

NYSE Euronex | EU | - |

Dalian commodity exchange | China | - |

Multi commodity exchange | India | - |

Intercontinental exchange | USA, Canada, China, UK | - |

Benefits of Online Trading.

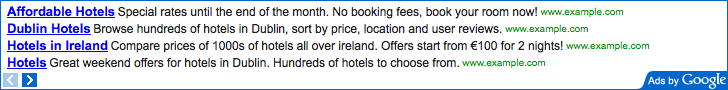

Trading commodities online is almost a one-stop shop. You virtually have everything you need when you log in to your trading account. Most online brokers will have real time quotes, charts, futures news, technical analysis programs and research available for their clients. This has opened the door for online traders to make more of their own trading decisions and implement trading strategies that once were not available to the average retail trader.

If you are going to day trade commodities and futures, you definitely want to trade online, unless you have someone else managing your account. Executions are almost instantaneous, which is a far cry from having to pick up the phone and call your broker to place orders and wait for your fill prices. Low Commissions. The commissions are also much lower. Today, you can trade many of the futures contracts for under $10 per round-turn with most online brokers. Low commissions make several strategies more feasible to trade; including spreads, day trading and short-term trading. For example, if you wanted to do a more sophisticated trading strategy where you have to combine futures and option, the commissions might cost you $150 per trade with a full-service broker. However, with an online futures broker, it might cost you less than $30. That gives you a much wider range where you can be profitable on trades.

Dangers of Online Trading

No Mentor. There are two main issues facing online futures traders. The first is that you don’t have someone watching over your shoulder and to help you with your trades. Many new traders will make several foolish mistakes that will likely cost them money. Having an experienced broker with whom you can discuss trading strategies will likely keep you out of trouble and more than make up for the commission savings of online trading.

As with any new venture, having a mentor can prove invaluable. Just being able to ask a trading question and receive a good answer in a few minutes can save you many hours or days of researching on your own. Many traders take for granted how much they actually learn from their brokers and how much time and effort they have saved. Over Trading. The second issue relates to the ever-increasing problem of over trading. This has been a problem with commodity traders for decades, but the advent of online futures trading has really accelerated the problem.

The commodities markets have the same lure to traders that Las Vegas has to gamblers. Typically, a new trader will come to the commodities markets with a trading strategy of holding trades for a period of weeks or months. As they watch the markets move up and down every day, they believe they can catch many of these smaller moves by getting in and out every couple of days. Commissions are cheap, so it seems like an easy proposition. Then, of course, the trader starts to get bored holding positions for a couple of days and starts day trading.

At this point, the trader is probably in way over his head. His account has probably suffered huge losses and a sizeable part of that is from commissions. His well-researched strategy for long-term trading does not apply to day trading, so he is trading without a good plan. In the end, he realizes he would have done very well if he just stuck to his original plan and his life would likely have been much less stressful.

The above scenario is a daily occurrence among those who trade commodities online. It is a lot for a new trader to handle. You have flashing quotes, scrolling charts with technical indicators and all it takes is a click of a button to place a trade. You don’t have to talk with a human to place a trade, so nobody will know what you’re up to.

Online trading can be a dangerous thing if you are not disciplined or have a gambling mentality. For those who are well disciplined and have a sound trading plan, trading commodities through an online broker is the best way to go.